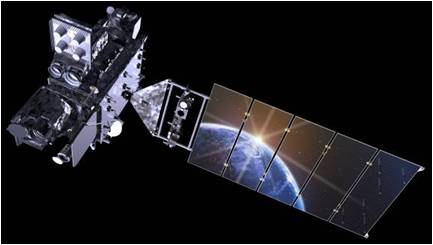

Until fairly recently, the satellite market for Materion Precision Optics' multispectral filter arrays consisted almost entirely of large government-sponsored programs like the U.S. Air Force's SBIRS GEO-2 reconnaissance satellite, the U.S. National Oceanic and Atmospheric Administration's GOES weather satellites, and similar large satellites for government meteorological agencies in Europe and Asia.

Until fairly recently, the satellite market for Materion Precision Optics' multispectral filter arrays consisted almost entirely of large government-sponsored programs like the U.S. Air Force's SBIRS GEO-2 reconnaissance satellite, the U.S. National Oceanic and Atmospheric Administration's GOES weather satellites, and similar large satellites for government meteorological agencies in Europe and Asia.

These government-sponsored environmental satellites provide their data and images to the public at no cost, but for a business or institution, that free data may not be exactly what they want, explained Dave Harrison, Business Development Manager, Image and Sensing, at Precision Optics in Westford, Mass.

"In the last half dozen years or so, [the satellite business] significantly expanded into the commercial arena with folks sending up smaller satellites," said Harrison. "These smaller satellites may be anywhere in size from a loaf of bread to a washing machine. They go exactly where you want them to go and take exactly the pictures you want them to take."

New small-satellite companies like San Francisco-based Planet and U.K.-based Clyde Space Ltd. and Surrey Satellite Technologies Ltd. sell satellites that provide imagery and data for everything from monitoring farm land and forests to tracking carbon emissions and mapping and monitoring energy and infrastructure assets.

"The market has been growing in fits and starts," said Harrison. "We have current orders and partnerships, but not as much as some had predicted a few years ago. Our expectations are that this will continue to grow over the next three to five years."

Even so, the market is evolving in Materion's direction, said Harrison. "These smaller satellites have the same type of capabilities as the government-sponsored GOES-type satellites, but at much lower cost because they do more volume and can trade on some of the specifications.

"Initially these companies bought cheaper, off-the-shelf optics from catalogs and used only a few specific bands," he said. "Now the industry leaders are asking questions and looking at multiple band (10, 20, and more) arrays and tighter tolerances to get more separation and more detail. They can take advantage of all the bands that are already defined from previous government sponsored space work. None of this would have been possible without our partnerships on these larger programs."